Get Involved

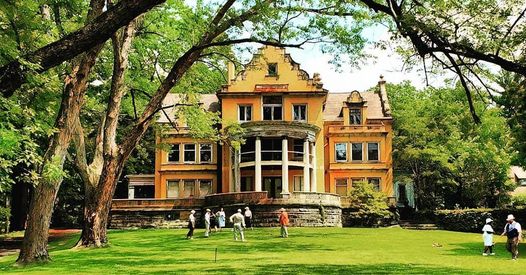

The rehabilitation and preservation of properties, delivering programs, and operating museums and archival facilities are a crucial parts of our mission in Crawford County, as well as opportunities to create jobs, attract tourists, develop a region, and create a legacy for you, your family, or your company.

Getting involved in this process can be done in a number of ways to meet your business, personal, or tax needs. Just a few possible options are outlined below. Please contact Josh Sherretts, Executive Director, to discuss specifics on any of these options.

Types of Donations

-

Single or Multi-Year Financial (Cash) Pledge

-

Individuals or businesses are encouraged to consider either a single year or multi-year financial pledge of support to the Crawford County Historical Society. This contribution can be made over up to three years (please reach out if other arrangements are preferred) to allow for the maximum deductions and impact of your financial giving. You will be recognized for your total pledge number (not just your annual amount) in publicity, in the building, and in any other legacy recognition efforts. The Society is also willing to bill monthly or yearly for these pledged funds fit your comfort and convenience.

-

Neighborhood Assistance Program Tax Deductions

-

Through the Neighborhood Assistance Program, any corporate entity with a Pennsylvania tax burden can contribute to the Crawford County Historical Society with up to a 75% tax deduction on each dollar contributed. For example: a donation of $250,000 a year for three years could reduce your yearly state tax burden by $187,500 per year PLUS guarantee recognition and cement your legacy in northwest Pennsylvania.

-

IRA Donations

-

Individuals who have reached an age where they need to take a required minimum distribution from a traditional IRA can do so through donating that RMD to charity, eliminating the tax burden that would otherwise be present from that distribution.

-

Appreciated Stock

-

Appreciated stock (that you have held for over one year) can be transferred to the Historical Society as a donation, eliminating capital gain taxes and giving the donor a tax-deduction.

-

Personal Property

-

Gifts of personal property including automobiles, collections, royalties, or mineral rights are all generous and appreciated contributions. Charitable tax deductions are available in the year of the gift for these items, also avoiding capital gains taxes if one was considering their sale. The Society reserves the right to include items donated with historical interest in their collection rather than divesting them as part of any unrestricted gift (We may ask to keep historical items for display in our museums!)

-

Real Estate with Life Tenancy

-

Receive a substantial income tax deduction by giving (deeding) your home or farm to the organization now. You continue to live there, maintain the property as usual, and even receive any income it generates. At your death, the organization will sell your property to support the capital campaign.

-

Outright Gift of Real Estate

-

One of the most overlooked gift forms is real estate. We will be happy to discuss the possible gift of land, a house, or vacation home. You will receive a tax deduction for the full fair market value, as well as avoiding all capital gain taxes.